“Khan was instrumental in forming John Marshall’s first Volunteer Income Tax Assistance clinic, adding to the law school’s community outreach clinics and programs.”

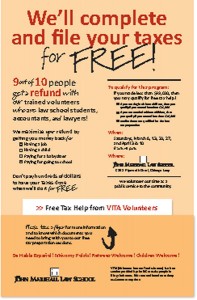

Displayed at various Chicago area community centers to promote the VITA program, the above poster and take-away flyer announced pro bono tax services for qualified individuals.

This past year, LLM in Tax Law candidate Lawrence Khan (JD ’10) was instrumental in forming John Marshall’s first Volunteer Income Tax Assistance (VITA) clinic, adding to the law school’s growing list of community outreach clinics and programs. VITA is an IRS grant program designed to promote and support free tax preparation service for underserved, low-income populations. These include the elderly, disabled, limited-English-speaking, non-urban, and Native American taxpayers. VITA’s training materials, software, financial backing, and review are all provided by the IRS, but it is up to individual VITA clinics to put the resources to good use. Each Saturday during the tax season, John Marshall student and faculty volunteers prepared and filed tax returns for individuals and families that fit within the IRS-mandated low-income taxpayer standards.

Khan became interested in the idea for a VITA clinic through his service as the Seventh Circuit lieutenant governor of pro bono initiatives for the American Bar Association (ABA) Law Student Division. With a growing number of residents in Chicago facing the increasing complexity of filing federal and state returns, Khan wanted to provide another tax return preparation service to help alleviate already over-crowded IRS tax preparation sites. The Chicago branch of the IRS is within close proximity to the John Marshall VITA clinic, which proved convenient for the lines of low-income taxpayers seeking assistance on their tax returns. Numerous individuals voiced their appreciation. Partnering with ABA representative Jennifer Anderson and Visiting Professor Juli Campagna, the team not only got VITA up and running by February, they made it an extremely productive tax season.

From left, volunteers at the law school on Saturday, February 20, 2010, were, seated, Visiting Professor Juli Campagna, VITA site program director; Christopher Ciesla, VITA taxpayer education coordinator from the IRS; and standing, Vita Zukaauskaite, August Appleton, Lawrence Khan, and Olga Komova.

Although the clinic was a victory for the community and the student body, Khan admits there were a few things he wishes he had done differently. One of the biggest challenges VITA ran into in its first year was having enough experienced tax return preparers. Law students and faculty are always busy, and tax is not a simple area to learn or teach. With its numerous nuances and exceptions, teaching student volunteers how to do income tax returns in a single session was a challenging task. In the future, VITA may be able to offer a paid teaching assistant position for those interested in running the administrative and training side of the clinic.

By Ashley E. Hayes JD ’10, LLM in Tax Law candidate

In future years, Khan hopes the VITA clinic will entice students and faculty to commit for multiple Saturdays, which would build a team mentality among volunteers and ensure a consistency of service. However, all members of the John Marshall community are encouraged to get involved.

Even though John Marshall’s VITA clinic may have run into some bumps its first year, the clinic, established and approved by the IRS, is already working to reduce any problems for the 2011 tax season. Khan will have graduated with his LLM by that time, but his insight and experiences will prove to be an invaluable asset to the students and faculty inheriting VITA in the coming seasons.